can you buy a house if you owe the irs

When the IRS files a tax lien it means the IRS is letting all other creditors know that it has a debt to collect from you. Unless you owe more than 10000 and youre not in a qualifying agreement.

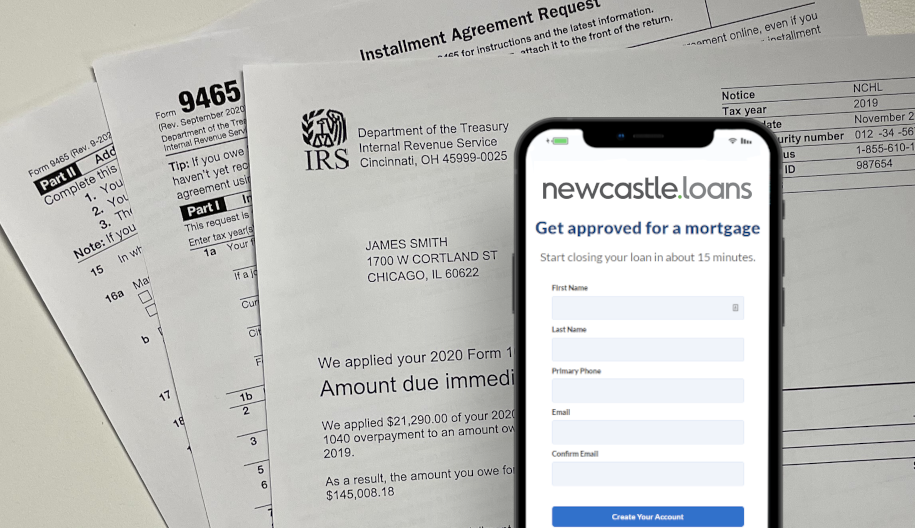

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

But making the process as seamless as possible will require strategic planning on your behalf.

. A tax lien in particular can hurt your chances of buying or selling a home. Yes you might be able to get a home loan even if you owe taxes. Can you get a conventional loan if you owe the IRS.

Can you get IRS debt forgiven. Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien. If your DTI is 44 without the IRS monthly payment determine how can pay and still keep your.

The short answer is yes. The good news is you can buy a house even if you owe tax debt. Can you buy a home if you owe the IRS money.

If you do not pay your taxes in time after the IRS has assessed your tax liability and sent. First the IRS doesnt generally file a tax lien. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a mortgage.

Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. The IRS can place a lien or levy on a home that is currently owned but the IRS is incapable of. The answer to this question is yes.

If youre not ready to give up on the house of your dreams call SH. The answer to whether you can qualify for a mortgage if youre on a tax repayment plan is yes as long as you meet the above conditions. Call IRS e-file Payment Services 247 at 1-888-353-4537 to inquire about or cancel your payment but please wait 7 to 10 days after your return was accepted before.

Our 4 step plan will help you get a home loan to buy or refinance a property. IRS debt relief is for those with a debt of 50000 or less. An individual can purchase a home if money is owed to the Internal Revenue Service IRS.

Home sales profits are considered capital gains taxed at federal rates of 0 15 or 20 in 2021 depending on. There are two types of qualifying agreements for. Yes you may be able to buy a single family house or condo in Los Angeles Calif.

The short answer is yes and no. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married. Outside of that you can apply for a discharge of the lien from a property.

It will take some hard work on your part though and the road wont be as straightforward as it will be for someone who. For the purchaser the only thing that reports to the IRS is the deduction of property taxes paid through escrow says. Its still possible but youll be seen as a riskier borrower.

Is money from the sale of a house considered income. When tax liens are involved it can make the process a stressful one. But as a buyer you dont have to worry about any of that.

A smaller monthly payment will impact your debt-to-income DTI ratio the least. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. Yes you might be able to get a home loan even if you owe taxes.

One reason the IRS might accept this is if youre selling the property and the proceeds will pay off. The IRS can seize some of your property including your house if you owe back taxes and are not complying with any payment plan you. A tax lien is a legal claim to your property the government can place when you fail to pay your tax debt.

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. Can i get a mortgage if i owe federal tax debt to the irs. While homeownership is a goal for many people owing taxes to the IRS can make.

Can you still buy a house.

Can You Buy A House If You Owe Taxes Credit Com

Can I Sell My House With A Tax Lien We Buy Houses Nationwide Usa Cash For Houses Ugly Homebuyers Near Me

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

Can You Buy A House If You Owe Taxes Credit Com

Can I Buy A House If I Owe Back Taxes Fortress Tax Relief

Can You Purchase A House If You Owe Taxes

Can You Buy A House If You Owe The Irs Sapling

Fix Your Serious Tax Situation With Help From Community Tax The Hill

Is It Possible To Buy A House If I Owe Back Taxes

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

How Much Tax Will I Pay If I Flip A House New Silver

Buying A House With A Tax Lien Here S What You Should Know

What To Do If You Owe The Irs And Can T Pay

Owe Money To The Irs You Have Options Credit Sesame

Can You Sell A House If You Owe Back Taxes

What Debts To Pay Off First X Best Ways To Decide The Turbotax Blog

Can You Buy A House If You Owe Taxes To The Irs Or State

What Documents Do I Need For Taxes If I Bought A House Last Year